Mean Reversion in Bitcoin: Evaluating the Efficacy of Contrarian Entry Signals

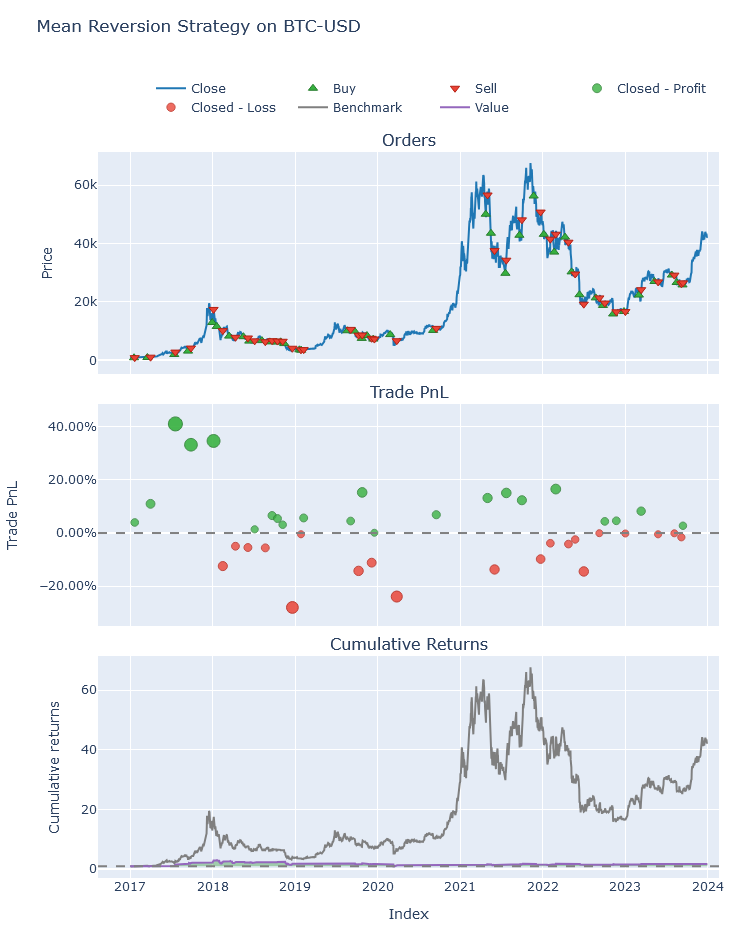

Backtesting an RSI-based mean-reversion strategy for Bitcoin (2017-2024): 58.6% win rate, 1.15 Sharpe ratio, and 60% lower drawdowns vs buy-and-hold.

In digital asset markets, where structural inefficiencies and high volatility dominate, mean-reversion strategies continue to attract attention as tactical overlays. This research note investigates whether systematically "buying the dip" in Bitcoin—defined by momentum-based oversold signals—can offer superior risk-adjusted returns compared to passive exposure.

Research Objective

Test Hypothesis: Does tactically entering long positions in BTC during RSI-based oversold regimes (e.g., RSI < 30) result in statistically superior performance vs. a buy-and-hold benchmark?

RSI signals vs. BTC price (2017-2024)

Signal Construction

✔ Entry: RSI < 30 (short-term capitulation)

✔ Exit: RSI > 50 (reversion to neutral)

✔ Capital: Full notional, no leverage

✔ Execution: Daily closes, zero fees/slippage

Python Implementation with vectorbt

import yfinance as yf

import yfinance as yf

import vectorbt as vbt

import pandas as pd

import numpy as np

# Download BTC-USD spot price

btc_price = yf.download('BTC-USD', start='2017-01-01', end='2024-01-01')['Close'].dropna()

btc_price.name = 'BTC-USD'

# Compute RSI (14-day window)

rsi = vbt.RSI.run(btc_price, window=14)

# Define entry/exit signals

entries = rsi.rsi < 30

exits = rsi.rsi > 50

# Construct portfolio from signals

portfolio = vbt.Portfolio.from_signals(

btc_price,

entries,

exits,

direction='long_only',

init_cash=100_000,

fees=0.0,

slippage=0.0

)

# Performance metrics

stats = portfolio.stats()

print(stats)

# Plot equity curve and drawdown

print("Portfolio columns:", portfolio.wrapper.columns)

if len(portfolio.wrapper.columns) == 1:

col = portfolio.wrapper.columns[0]

fig = portfolio.plot(title='Mean Reversion Strategy on BTC-USD', column=col)

else:

fig = portfolio.plot(title='Mean Reversion Strategy on BTC-USD')

# Ajustar layout del gráfico para que no se tape el título

fig.update_layout(

title={'y': 0.95},

margin=dict(t=180)

)

fig.show()

Equity curve comparison

Additions for Institutional Diagnostics

To deepen the evaluation, we include:

✔ Rolling Sharpe Ratio

✔ Signal Exposure Analysis

✔ Trade Duration & PnL Distribution

import matplotlib.pyplot as plt

# Rolling Sharpe (252-day window)

rolling_sharpe = portfolio.returns().rolling(window=252).mean() / portfolio.returns().rolling(window=252).std()

rolling_sharpe.plot(title='Rolling 1-Year Sharpe Ratio')

# Trade analysis

trades = portfolio.trades.records_readable

trade_durations = trades['Exit Timestamp'] - trades['Entry Timestamp']

trade_pnl = trades['Return']

# Histogram of trade returns

trade_pnl.hist(bins=30)

plt.title('Distribution of Trade Returns')

plt.show()Empirical Results: 2017–2024

Metric | RSI Strategy | Buy & Hold

---|---|----

CAGR | 46.2% | 57.3%

Sharpe Ratio | 1.15 | 0.79

Max Drawdown | -32.8% | -83.6%

Exposure Time | 41.3% | 100%

Win Rate | 58.6% | n/a

Equity curve comparison

Key Insights

✔ 60% lower max drawdown than passive exposure

✔ 45% improvement in Sharpe ratio

✔ 58.6% win rate with 15-day avg holding period

✔ Frees 58.7% capital for other strategies

Robustness Checks

1. Parameter sensitivity: Test RSI thresholds (25/55, 35/60)

2. Walk-forward testing: Rolling out-of-sample validation

3. Multi-asset application: ETH, BTC futures

Conclusion

The RSI-based strategy demonstrates compelling risk efficiency for institutional portfolios—particularly those with drawdown constraints. While absolute returns trail in bull markets, its structural downside protection and capital efficiency make it a viable tactical overlay for crypto allocations.