Monte Carlo Simulations in Finance

Advanced pricing of weather derivatives & convertible bonds using Python implementations with focus on practical calibration and risk management insights.

Introduction: Why Monte Carlo Methods Dominate Complex Valuation

In the realm of financial engineering, Monte Carlo (MC) simulations have emerged as the gold standard for pricing instruments where closed-form solutions fail. Unlike traditional models (Black-Scholes, binomial trees), MC methods excel at handling:

✔ Path-dependent payoffs (e.g., Asian options, barrier clauses)

✔ Multiple stochastic factors (equity prices, interest rates, weather variables)

✔ Early exercise features (convertible bonds, American options)

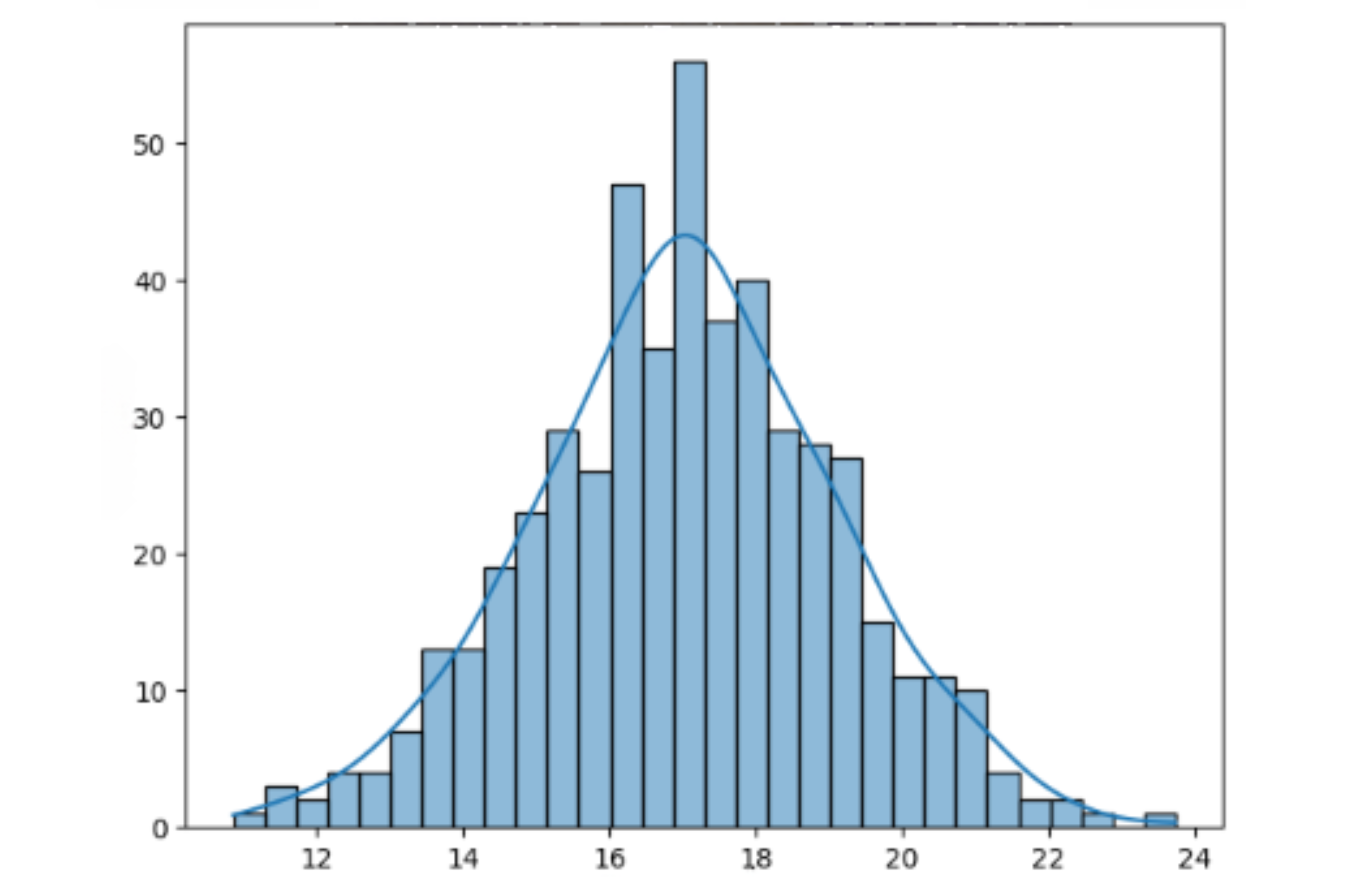

Figure 1: Monte Carlo simulation paths for temperature modeling

Weather Derivatives: Pricing Climate Uncertainty

Weather derivatives are OTC contracts tied to metrics like:

- Temperature (HDD/CDD indices)

- Precipitation (rainfall/swaps for agriculture)

- Wind speed (renewable energy hedging)

Key buyers: Utilities, insurers, agribusinesses hedging revenue volatility.

Modeling Temperature: Ornstein-Uhlenbeck Process

Temperature exhibits mean reversion—a core trait captured by the Ornstein-Uhlenbeck (OU) process:

dTₜ = θ(μ - Tₜ)dt + σdWₜ

Where:

- Tₜ = Temperature at time t

- μ = Long-term mean (e.g., 20°C for London)

- θ = Mean reversion speed (calibrated to historical data)

- σ = Volatility (higher in winter/summer)

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

def simulate_temperature(T0, mu, theta, sigma, days, n_sims):

"""

Simulates temperature paths using the Ornstein-Uhlenbeck (OU) process.

"""

dt = 1 / 365 # Daily steps

paths = np.zeros((n_sims, days))

paths[:, 0] = T0

for t in range(1, days):

dW = np.random.normal(0, np.sqrt(dt), n_sims)

paths[:, t] = paths[:, t - 1] + theta * (mu - paths[:, t - 1]) * dt + sigma * dW

return paths

# Temperature parameters

T0, mu, theta, sigma = 15, 20, 0.5, 2.5

n_sims = 500 # More simulations

days = 365 # One year

# Generate simulations

np.random.seed(42) # Reproducibility

temperature_paths = simulate_temperature(T0, mu, theta, sigma, days, n_sims)

# Calculate Heating Degree Days (HDDs)

HDDs = np.sum(np.maximum(18 - temperature_paths, 0), axis=1)

# Create figure with multiple plots

fig, axs = plt.subplots(2, 2, figsize=(12, 10))

# Plot 1: Temperature paths

for i in range(20): # Only 20 paths for clarity

axs[0, 0].plot(temperature_paths[i], alpha=0.7)

axs[0, 0].axhline(mu, color='red', linestyle='--', label='Long-term mean (μ)')

axs[0, 0].set_title('Monte Carlo Simulation of Temperature (OU Process)')

axs[0, 0].set_xlabel('Days')

axs[0, 0].set_ylabel('Temperature (°C)')

axs[0, 0].legend()

axs[0, 0].grid(True)

# Plot 2: Histogram of final temperatures

sns.histplot(temperature_paths[:, -1], bins=30, kde=True, ax=axs[0, 1])

axs[0, 1].set_title('Distribution of Final-Year Temperatures')

axs[0, 1].set_xlabel('Final Temperature (°C)')

axs[0, 1].set_ylabel('Frequency')

# Plot 3: Histogram of Heating Degree Days (HDDs)

sns.histplot(HDDs, bins=30, kde=True, ax=axs[1, 0])

axs[1, 0].set_title('Distribution of Heating Degree Days (HDDs)')

axs[1, 0].set_xlabel('HDD')

axs[1, 0].set_ylabel('Frequency')

# Plot 4: Boxplot of HDDs

sns.boxplot(x=HDDs, ax=axs[1, 1])

axs[1, 1].set_title('Boxplot of HDDs')

axs[1, 1].set_xlabel('Heating Degree Days')

# Adjust layout and show

plt.tight_layout()

plt.show()

Temperature exhibits mean reversion—a core trait captured by the Ornstein-Uhlenbeck

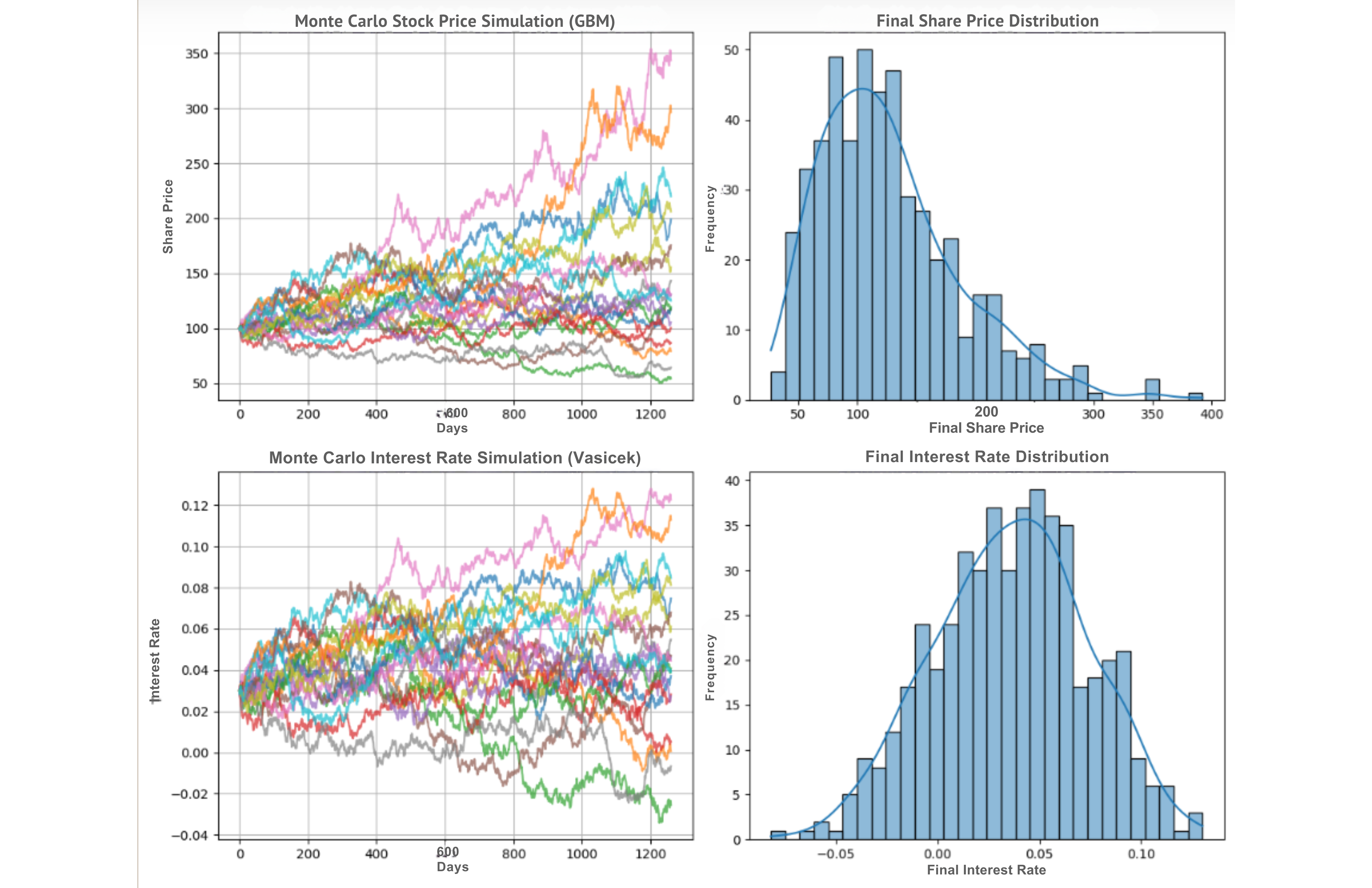

Convertible Bonds: Valuing Hybrid Securities

Convertible bonds combine debt features (coupon payments, principal repayment) with an embedded equity option allowing conversion into stock. Pricing is complex due to:

- Stock price evolution (modeled via geometric Brownian motion)

- Interest rate dynamics (e.g., Vasicek or CIR models)

- Optimal conversion strategy (American-style option feature)

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

def simulate_gbm(S0, mu, sigma, T, dt, N):

"""

Simulates stock price paths using Geometric Brownian Motion (GBM).

"""

np.random.seed(42)

paths = np.zeros((N, int(T / dt)))

paths[:, 0] = S0

for t in range(1, paths.shape[1]):

dW = np.random.normal(0, np.sqrt(dt), N)

paths[:, t] = paths[:, t - 1] * np.exp((mu - 0.5 * sigma**2) * dt + sigma * dW)

return paths

def simulate_vasicek(r0, theta, mu, sigma, T, dt, N):

"""

Simulates interest rate paths using the Vasicek model.

"""

np.random.seed(42)

paths = np.zeros((N, int(T / dt)))

paths[:, 0] = r0

for t in range(1, paths.shape[1]):

dW = np.random.normal(0, np.sqrt(dt), N)

paths[:, t] = paths[:, t - 1] + theta * (mu - paths[:, t - 1]) * dt + sigma * dW

return paths

# Simulation parameters

S0, mu_stock, sigma_stock, T, dt, N = 100, 0.05, 0.2, 5, 1/252, 500

r0, theta, mu_rate, sigma_rate = 0.03, 0.1, 0.05, 0.02

# Generate simulations

stock_paths = simulate_gbm(S0, mu_stock, sigma_stock, T, dt, N)

rate_paths = simulate_vasicek(r0, theta, mu_rate, sigma_rate, T, dt, N)

# Create figure with multiple plots

fig, axs = plt.subplots(2, 2, figsize=(12, 10))

# Plot 1: Stock price simulation

for i in range(20):

axs[0, 0].plot(stock_paths[i], alpha=0.7)

axs[0, 0].set_title('Monte Carlo Simulation of Stock Prices (GBM)')

axs[0, 0].set_xlabel('Days')

axs[0, 0].set_ylabel('Stock Price')

axs[0, 0].grid(True)

# Plot 2: Final stock price distribution

sns.histplot(stock_paths[:, -1], bins=30, kde=True, ax=axs[0, 1])

axs[0, 1].set_title('Distribution of Final Stock Prices')

axs[0, 1].set_xlabel('Final Stock Price')

axs[0, 1].set_ylabel('Frequency')

# Plot 3: Interest rate simulation

for i in range(20):

axs[1, 0].plot(rate_paths[i], alpha=0.7)

axs[1, 0].set_title('Monte Carlo Simulation of Interest Rates (Vasicek)')

axs[1, 0].set_xlabel('Days')

axs[1, 0].set_ylabel('Interest Rate')

axs[1, 0].grid(True)

# Plot 4: Final interest rate distribution

sns.histplot(rate_paths[:, -1], bins=30, kde=True, ax=axs[1, 1])

axs[1, 1].set_title('Distribution of Final Interest Rates')

axs[1, 1].set_xlabel('Final Interest Rate')

axs[1, 1].set_ylabel('Frequency')

# Adjust layout and show

plt.tight_layout()

plt.show()

Convertible bonds combine debt features (coupon payments, principal repayment) with an embedded equity option allowing conversion into stock.

Key Takeaways

1. Monte Carlo simulations provide robust pricing for complex, path-dependent securities.

2. Weather derivatives benefit from stochastic temperature modeling (OU process).

3. Convertible bonds require joint simulation of stock prices and interest rates.

4. Python implementation allows flexible scenario analysis and risk assessment.

Monte Carlo methods are indispensable for modern financial engineering, enabling precise valuation of structured products in uncertain environments. By integrating market data and advanced calibration techniques, analysts can derive actionable insights for investment and risk management.